Forex Indicators That Don't Repaint

Contents

- What are repainting indicators?

- Repainting the latest candle

- Repainting by candles

- Do all indicators repaint?

- Why practice indicators repaint?

- Repainting in multi-timeframe (MTF) indicators

- How to know if the indicator is repainting?

- How to tell if an indicator is repainting if I cannot backtest it?

- Is an indicator that repaints useless?

- Examples of proficient repainting indicators

- ZigZag

- Fractals

- Semafor

- Eye of Gravity

- How to fix indicator repainting?

- Other platforms

- cTrader

- NinjaTrader

- TradingView

- Conclusion

Using technical indicators is very popular among Forex traders. Lots of them utilize custom indicators with platforms like MetaTrader, cTrader, NinjaTrader, and TradingView. Sooner or after, a new trader either encounters a mention of indicator repainting or stumbles upon such an indicator itself. And then, what is a repainting indicator? If you wonder what a repainting indicator is, then this tutorial is for you.

The concept of repainting and non-repainting indicator often confuses traders, especially new ones. However, there is nothing difficult in these concepts and it is besides very of import for traders to sympathize what repainting indicator is and how to recognize one considering there are many scams involving the auction of repainting Forex indicators online.

What are repainting indicators?

Repainting means that the indicator is updating its display, changing what has already been on the nautical chart. There are two major types of repainting:

Repainting the latest candle

Nearly all technical indicators constantly update the electric current candle value with each new tick. It is a totally normal behavior. The Close price of the current candle changes for as long as the candle is forming, and so if the indicator is based on Close prices (which is ofttimes a default applied price blazon), the indicator's value at the electric current bar will change also. This isn't bad and many traders wouldn't even call this repainting. To mitigate the results of such repainting, traders should look for the candle to close and a new one to open up before taking whatever consideration of the indicator's value. However, if you ready the indicator price type to Open, this ceases to be a problem at all. For example, run across the latest candle repainting with these two classic RSI indicators — the ruby-red one is applied to Open up, so its value never changes afterward it has been calculated for the given candle; the blue ane is practical to Close and is updating with each new tick:

Repainting past candles

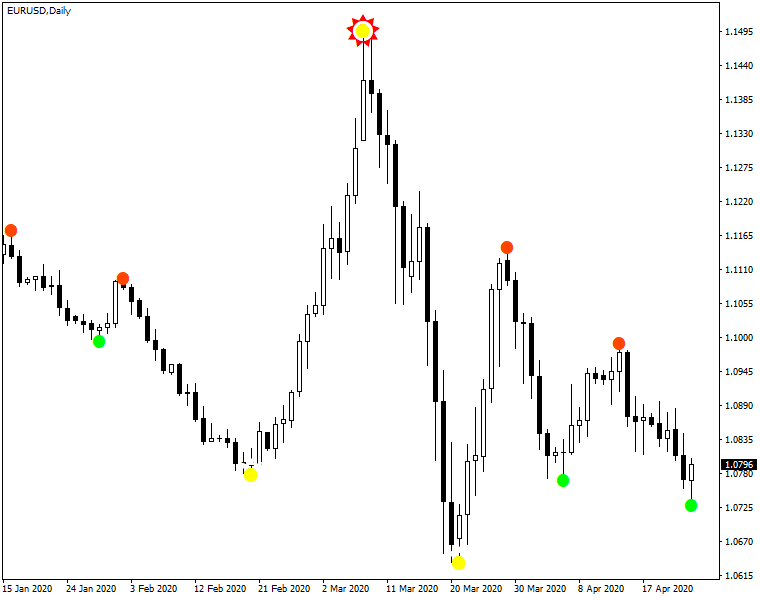

Some indicators are changing their signals on past candles. It ways that the indicator'due south lawmaking is looking at the future candles to pigment the display for the past bars. Of course, a trader cannot rely on such an indicator in live trading as information technology won't be seeing hereafter candles when attached to a chart. This is a bad kind of repainting. For example, you tin can see how a famous repainting indicator Semafor keeps repainting the signals on sometime candles. If you lot would have acted on any of them, y'all would become yourself in trouble:

If you await at the same indicator's output in retrospect, it looks perfectly precise and impeccably timed:

Practise all indicators repaint?

Of form, not all indicators are repainting. In fact, the bulk of the technical indicators people utilize in FX trading are not-repainting. A normal (non-repainting) indicator doesn't change its signal value for the candle later that candle has closed. Not-repainting indicators never await into the hereafter to give a betoken for the current candle — they are calculated purely using the electric current or past candles. Such indicator volition never modify its value on one of the past candles should some new data make it.

Why practice indicators repaint?

Repainting of the past candles when added intentionally by the indicator developer is normally aimed at fooling potential users to make the signals appear more accurate or timely. What appears as perfect signals on a historical chart will actually plough out to be nowhere near every bit good in alive trading. The historical nautical chart was showing the indicator with all its signals already repainted using the chart data that hadn't been available at the fourth dimension of those signals.

In short, a repainting indicator can be made to look much more appealing than a non-repainting indicator — its historical entry and be signals very precise and perfectly timed.

Sometimes, an indicator tin can be made repainting intentionally just without whatever malicious intent. This tin exist useful to make further chart analysis easier or to highlight some peculiarities of the price action. In any case, the developer should clearly disclose the repainting nature of the indicator. Otherwise, information technology is by and large considered cheating or even scamming by the community of Forex traders.

Occasionally, an indicator can be made repainting completely unintentionally. It is possible to lawmaking an indicator in such a way that it "looks" at the next bar (to the correct) instead of previous confined to summate its signal value. This error can exist committed by a beginner developer without giving it a 2nd thought. That is why information technology is important for indicator coders to examination and backtest their work before releasing it to the public to avoid being accused in repainting scam.

Lastly, indicators that repaint the current bar based on Shut/High/Low price (similar the bluish RSI in the example above) are coded that way intentionally, and the last candle repainting is a normal behavior for them. If you lot employ such indicator in trading, you should take a cue just from the finished candles.

Repainting in multi-timeframe (MTF) indicators

An frequently-disregarded kind of repainting consequence is the one that occurs in multi-timeframe (MTF) indicators. An MTF indicator is an indicator that uses information from other timeframes (normally, college ones). For example, a simple multi-timeframe moving average indicator could be displaying an SMA value from a daily timeframe on your H1 chart.

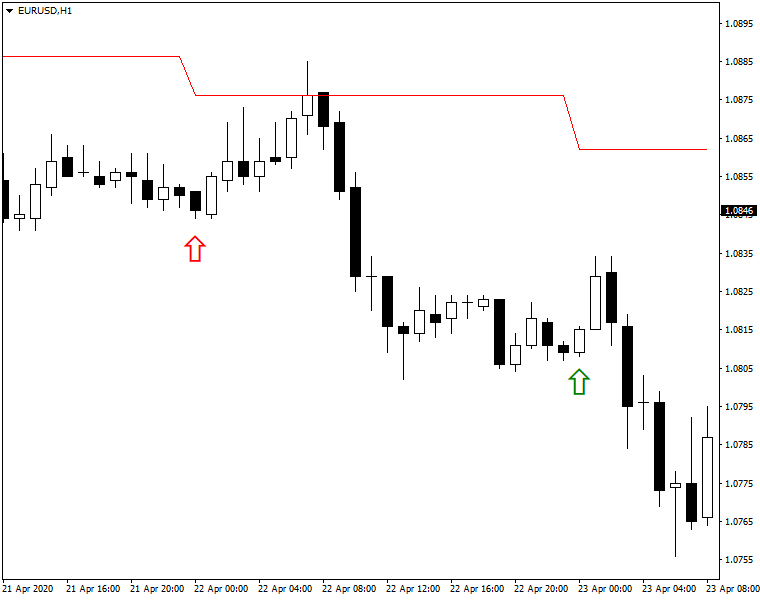

Some MTF indicators tin can expect very appealing thank you in large to their repainting effect. When an MTF indicator is attached to a nautical chart of a lower timeframe, its historical values are displayed so every bit if the Open/High/Low/Close values of the higher timeframe candle are known at the first candle of the lower timeframe.

For example, on the historical nautical chart beneath is the MTF MA of D1 attached to H1. As you can run into, the higher timeframe MA value becomes visible on the first candle of the day (marked with the reddish arrow). However, in live trading, it wouldn't announced until the first candle of the side by side day (marked with the light-green arrow):

When trading with multi-timeframe indicators, you lot must always call back to keep an eye for such a repainting and never judge the efficiency of such indicators by their advent on historical charts.

How to know if the indicator is repainting?

The easiest way to check and verify in MT4 or MT5 platforms is the Strategy Tester. You tin can launch a visual backtest of any indicator and come across if its signals change post factum. Here is how to do information technology:

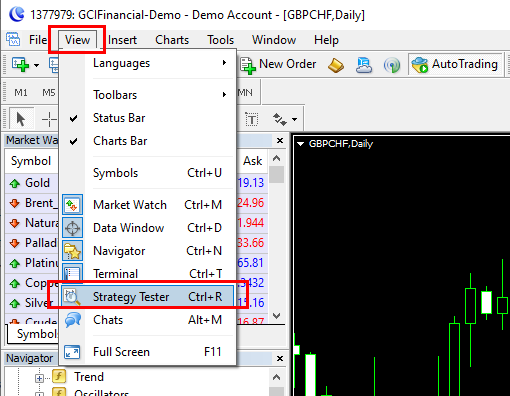

- Open the Strategy Tester by pressing Ctrl+R on your keyboard or via the menu: View->Strategy Tester.

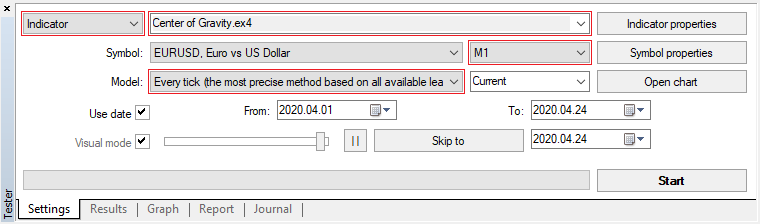

- Utilise the Settings tab to set up a backtest of the indicator you wish to cheque for repainting. Switch from Expert Advisor to Indicator. Visual way will plow on automatically. Select the indicator name via the drop-down list. Set timeframe to M1 - unless the indicator doesn't work on that timeframe; in this case, set up the smallest possible timeframe. Switch Model to Every tick. Change other settings to your liking or if the indicator requires some specific configuration.

- Run the test, adjusting the speed to exist able to observe if signals alter on the past candles when the new ones make it.

You tin also watch the entire process in detail in this video:

As y'all can see, information technology isn't hard to tell if the indicator is repainting or not.

One potential problem with some particularly malicious indicator sellers could be that they detect whether indicator is being tested in Strategy Tester and skip repainting if and so; this would conceal the repainting nature of that indicator, merely it would too reveal how inferior its signals are (every bit the repainting is mostly washed to make signals look more than accurate than they are).

How to tell if an indicator is repainting if I cannot backtest information technology?

If the developer doesn't want to provide a demo version for backtesting, ask directly whether the indicator is repainting or non-repainting. Developer might acknowledge its repainting nature because, perhaps, the indicator isn't supposed to be used for taking direct trading signals. If the programmer insists that the indicator is not-repainting but all the provided historical chart screenshots prove perfect entries and exists that are too proficient to be true, the chances are the indicator is a repainting i.

Is an indicator that repaints useless?

Not all repainting indicators are bad. Every bit you saw above, indicators that repaint the latest candle aren't bad at all and provide great information to technical analysts regardless of this trait. Indicators that repaint their values on the already completed candles tin also exist quite useful. To not use them at all considering they repaint isn't always a smart choice. Of course, you lot must know how they part and acknowledge the fact that they repaint.

Examples of good repainting indicators

ZigZag

One of the about popular repainting indicators every trader encounters later installing a MetaTrader platform is ZigZag. It is an crawly indicator but it repaints. To use it properly, traders have to be enlightened that information technology repaints and utilise its lines and nodes solely for building support and resistance zones or trend lines.

Fractals

Fractals (or Bill Williams' Fractals) is some other fascinating repainting indicator that is present in MT4 and MT5 platforms past default. Fractals are fatigued using simple rules: fractal upward arrow requires a loftier surrounded past two lower highs from each side; fractal downwardly arrow requires a low surrounded by two higher lows from each side. As yous can come across, information technology needs five candles in total to display an pointer, and two of the candles should be in the hereafter relative to the current one. This results in the repainting behavior. A trader should wait for 2 next candles to finish forming before because the output of the Fractals indicator.

Indicators such as ZigZag and Fractals are not meant to deceive traders. They are effective in identification of support and resistance levels.

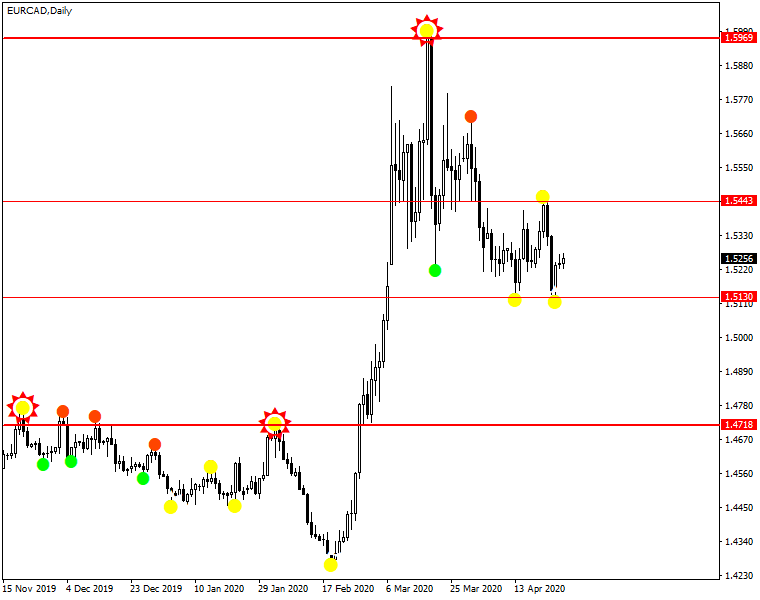

Semafor

Semafor indicator had already been mentioned above when we were get-go talking about indicators repainting the signals of the previous candles. Notwithstanding, Semafor indicator is a worthy custom indicator bachelor for many trading platforms. Despite the fact that it looks too adept to be true, lots of people rely on it for assay of the past toll action and for marking down the important toll levels on the chart. Numerous threads on popular FX forums confirm that it has no lack of fans to this solar day. The below nautical chart shows an instance markup of short-term and long-term support and resistance levels using the Semafor indicator:

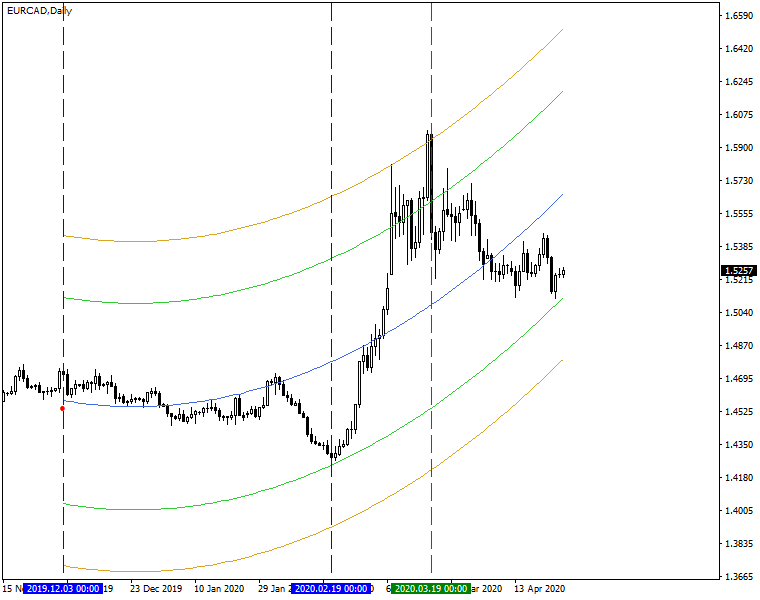

Center of Gravity

Center of Gravity is displayed above in the tutorial on detecting repainting with Strategy Tester. Information technology is a variant of linear regression channels and is extremely useful in two tasks - detecting tendency direction and measuring the volatility of the by N candles. Of course, information technology is crucial to always proceed in mind the repainting nature of the indicator and non to use it for direct generation of entry and exit signals for your trades. The nautical chart example below shows a articulate trend direction (upward), a menstruum of depression relative volatility (between the ii blueish lines), a menstruum of excess volatility (between the 2d blue line and the light-green line), and the electric current period of "normal" volatility.

How to fix indicator repainting?

If you lot are wondering if there is any style to edit an indicator so it doesn't repaint, then you take some options available.

Fixing a repainting indicator entails reprogramming it via its MQL source lawmaking. In that location is no some single method that is applicative to all repainting indicators for making them non-repainting.

Indicators that rely on the Close/High/Depression of the electric current candles can be "fixed" by making them draw signals simply later the current candle closes.

Repainting indicators that take reward of looking into the future candles tin be fixed past removing the code that does so. Unfortunately, the indicator might become completely unusable after that as it draws to many false signals, which previously had been hidden by the repainting process.

In both cases, you lot should either know some coding to try fixing the repainting or hire a professional MQL developer to fix it. If you don't take access to the source code of the indicator (.mq4 or .mq5 file) and only have compiled indicator (.ex4 or .ex5 file), it will be incommunicable to set up the repainting.

Other platforms

MetaTrader is arguably the most popular trading platform in online retail Forex trading. However, in other platforms, repainting indicators can too pose a problem when an unsuspecting buyer can be scammed past fraud sellers. Fortunately, as y'all have seen above, not all repainting indicators are useless - the trick is to know whether the indicator repaints and to use it appropriately.

cTrader

cTrader isn't complimentary from repainting indicators. cAlgo indicators can suffer from the same types of repainting as MQL indicators. Indicators based on Shut price repaint the latest candle's value. Malicious, poorly coded, or special purpose indicators can repaint the values on by candles. The problem is that it isn't possible to run indicator backtests in cTrader, then, unlike in MetaTrader, there is no fast and like shooting fish in a barrel way to check if an indicator repaints. The best mode is to detect how the indicator functions on some very brusque timeframe or, if you understand C# lawmaking, analyze the source code of the indicator (when it is available).

Here is a time-lapse of ZigZag indicator repainting in cTrader on a tick chart:

NinjaTrader

NinjaTrader is non immune to repainting indicators either. If you use this trading platform, you have to be aware of the repainting nature of the indicators you apply. To check whether an indicator is a repainting or non-repainting one, you tin use Market Replay facility of NinjaTrader. It effectively allows you to backtest any indicator on a chart of your choice.

Hither is a Market Replay demonstration of the Fractals indicator repainting in NinjaTrader - notation that signals appear merely two candles in the time to come:

TradingView

TradingView is a very popular charting platform among all kinds of financial traders (including crypto and Forex). The main repainting indicator problem - when indicator values on erstwhile candles are updated with the data from time to come candles apply to TradingView the same as it does to other platforms. You can examination to check if the indicator is repainting either by running it on a i-2nd chart as done with Fractals in the blitheness below, or you tin can launch the Replay characteristic to run a fast-frontwards replay of any corporeality of confined from any timeframe and encounter how the indicator behaves.

The other important type of repainting problem pertinent to TradingView becomes relevant when using data from upper timeframe candles. It is possible for a strategy script to come across the Open up, Loftier, Low, and Close data of the upper timeframe candle during processing of its "inner" candles of the lower timeframe. This causes backtests to "predict" the minimum and maximum prices for the hereafter menstruation (based on the upper timeframe), which can be enormously misleading compared to the actual alive tests of the strategy script.

This is mitigated by fixing the strategy script's source code so it counts the candles on the lower timeframe and accesses the upper timeframe's candle data merely when enough candles on the lower timeframe are closed (due east.g., sixty 1-infinitesimal candles for an H1 upper timeframe or 24 one-hour candles for a D1 upper timeframe, then on).

In study scripts (indicators), this is fixed using the lookahead parameter of security function by setting information technology either to barmerge.lookahead_on or to barmerge.lookahead_off to prevent "seeing" the unfinished upper timeframe candle'south data.

Unfortunately, this cannot be helped if you are dealing with a closed-source script. Information technology could be a repainting ane and yous wouldn't be able to verify or fix that via the source code.

Decision

When taking trading signals for entries and exits from an indicator, make sure it is a not-repainting i. Trading using signals from repainting indicators will cause only loss and frustration. Ever check if the indicator is repainting or non-repainting via Strategy Tester before buying one. Demand full disclosure from its developer. Don't get yourself lured by prissy looking repainted charts with seemingly perfect historical signals that catch every low and loftier.

A practiced repainting indicator always makes it articulate that information technology is indeed repainting. A bad repainting indicator disguises every bit a not-repainting one, tricking the users and bringing losses to their accounts.

If you want to get news of the most recent updates to our guides or anything else related to Forex trading, you tin subscribe to our monthly newsletter.

Forex trading bears intrinsic risks of loss. You lot must empathize that Forex trading, while potentially profitable, can brand y'all lose your money. Never trade with the money that yous cannot afford to lose! Trading with leverage tin can wipe your account even faster.

CFDs are leveraged products and as such loses may exist more than the initial invested capital letter. Trading in CFDs carry a high level of risk thus may non be advisable for all investors.

Forex Indicators That Don't Repaint,

Source: https://www.earnforex.com/guides/what-is-repainting-indicator-in-forex/

Posted by: mendenhallcontable.blogspot.com

0 Response to "Forex Indicators That Don't Repaint"

Post a Comment