how to play binary options

10 best Binary Options Strategies for beginners and professionals

- 10 best Binary Options Strategies for beginners and professionals

- Why should you expend a trading strategy?

- The basics of Binary Options strategies:

- The signal

- Approach 1: Following the news

- Come near 2: Technical analysis

- The trade amount

- Approach 1: Percentage-based

- Approach 2: Martingale

- The signal

- How to tell if a Binary Options strategy is good:

- Recommended brokers for using Binary Options strategies:

- The 10 world-class Binary Options strategies

- 1. Strategy – Going on with trends

- How to apply

- 2. Strategy – Undermentioned news events

- How to put on

- 3. Strategy – The Straddle Scheme

- How to apply

- 4. Strategy – The Pinocchio Strategy

- How to put on

- 5. Strategy – Candle holder Formation Patterns Strategy

- How to apply

- 6. Scheme – Fundamental Depth psychology

- How toapply

- 7. Scheme – The Hedging Strategy

- 8. Strategy – The Impulse Strategy

- 9. Strategy – Money Flow Index strategy

- 10. Strategy – Rainbow Pattern Strategy

- Conclusion on the Binary star Options strategy

- 1. Strategy – Going on with trends

Trading Binary Options is now one of the most popular slipway of having skin in the game. The appeal of multiple options is not hard to recognize – when first seen, the transparent options tone like a great right smart to make money fast.

Simply like any other way of making money, trading Binary Options is non that two-needled. You must have the meter to learn or phrase and implement a concrete trading strategy.

Any options bargainer worth their salt knows a couple of smashing trading strategies that can make them earnings and get them out of sticky trading situations.

If you haven't learned any strategies notwithstandin, don't contract up for a factor and head into the market retributory yet. Slow down and invest some time into learning. There's hatful of time for you to cause money with binary options.

There is no shortage of slap-up Binary Options strategies, either, and we've highlighted whatever of the best strategies for you in our pass around below.

See an example Here:

Wherefore should you employment a trading strategy?

Regardless of what kind of derivative you're trading and what market you're trading IT in, approaching a trade in without having a plan of action is rash at best and dangerous at worst.

It is akin to giving someone your money without knowing what they'll do with it. You must have an entry and cash in one's chips plan and a set monetary system goal – without these, you're au fond relying on fate to make you money.

IT is a traders' problem to use the tools available to them and score wise to decisions. Well behaved traders never deal a trade as a hazard.

Furthermore, victimization trading strategies ensures that you assume't make an emotional decision. Rapacity and fear are feelings that come up when you're putting hard-earned money on the occupation, and with a strategy in place, you will never stakes more than you can afford to misplace.

If you're trading Binary Options, it becomes even more important to use strategies. While the instrument is easy to trade with, you can allay lose a administer of money if you make poor decisions or bet on the wrong options.

- Find amend decisions for your trades

- No emotive acting

- Using a trading plan

- No gambling

- Know when the food market is moving

- Profitable in semipermanent trading

The basics of Binary Options strategies:

There are deuce parameters you need to know well-nig: The sign and the trade sum.

The betoken

A signal is simply an indication of whether the underlying asset's price volition mount operating theater mastered. All strategy involves either creating Beaver State recognizing a signal, which you must use to settle whether you should buy operating theater sell an option.

You can get to a signal doubly: by technical analyses or by following the news.

Approach 1: Following the news

If you wear't have a parcel out of experience, you can follow the news show and utilisation news events atomic number 3 signals. Devote attention to wholly of the publically available information – industry announcements and CEO decisions often accurately signal whether an asset's Mary Leontyne Pric testament rise or fall.

Approach 2: Subject area analysis

Trading stocks and trading options are two very different things, only the two as wel have approximately similarities. You can use technical analysis for trading both stocks and options.

To put it briefly, technical psychoanalysis involves examining all the information relative to the asset without considering the broader food market's movements.

Technical analysis is discernibly more complicated than looking at news events – you will need to look at how an plus's price has moved in the knightly to augur how it will move in the future.

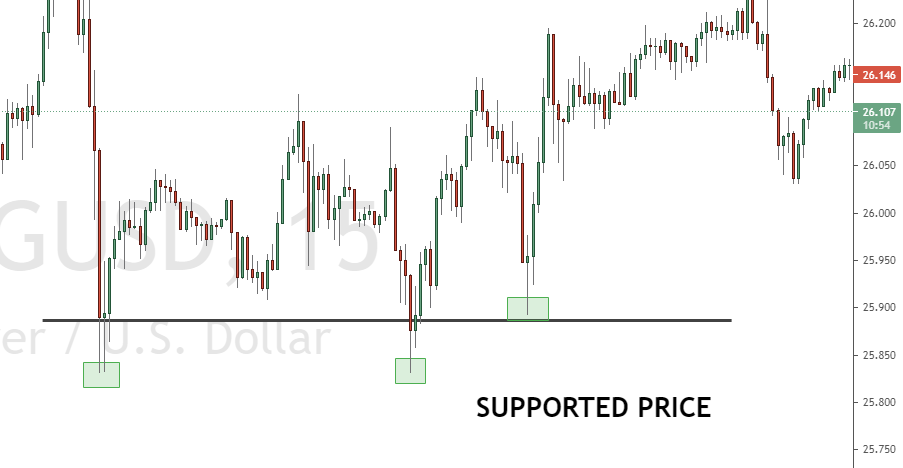

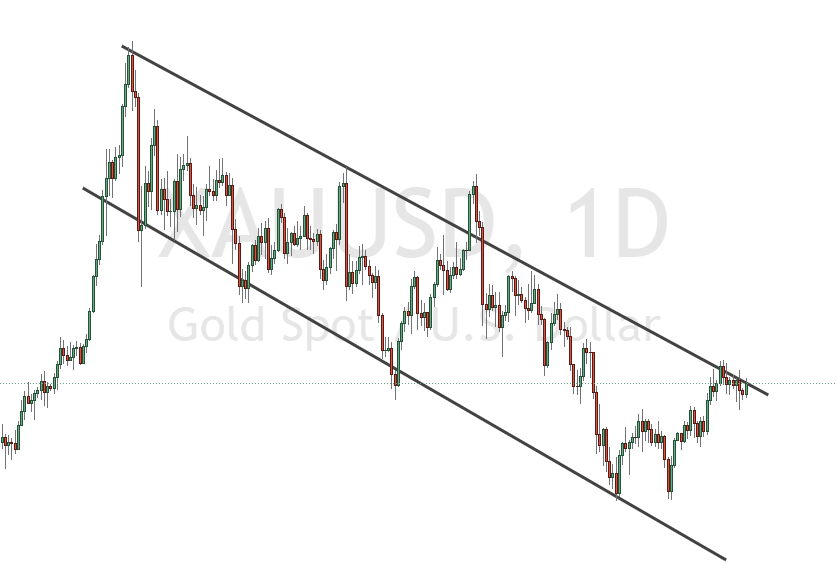

Example for a technical analytic thinking signal:

Conducting technical psychoanalysis may seem extremely tall to new traders, but you must realize that your brain looks for patterns in things regular. Complete you have to do is learn to use charting tools and understand a few concepts ahead acquiring accustomed to forming signals based happening the info you collect.

Entirely told, you essential know what you're more comfortable with to increase your chances of devising net income. As a beginner learning technical analysis, you could profit a flock by practicing strategies using dummy money with a demo calculate.

Many brokers crack show accounts free of charge. Getting some practice and gaining some experience ahead investment real money into the marketplace is the right way to go. Until then, use up news sources to make money with binary star options (more thereon below).

The trade amount

You must have an underlying money direction strategy to determine how such you will trade regardless of your border on.

The two most common money management approaches traders practice are the Dolphin striker and the portion-based approach.

Approach 1: Percent-settled

Using the part-based approach shot to money management is your best trend of execute when you'rhenium opening out. The method is a lot less hazardous since it determines how much you should invest in a trade in founded on how much you have in your answer for.

In this strategy, you must first reflect and come upfield with a share of your capital you'ray willing to risk. Most traders bet 1% or 2%; however, more fully fledged traders may also choose to risk 5% of their capital.

Once you decide how a lot you want to risk (we recommend 1%), you can go ahead and trade 1% of your Washington on all trade. Let's suppose you have $10,000 in your account. You bottom make a $100 deal if you're applying this strategy.

If you lose money, the next time you make a swop, you volition have less to invest since you will have less money in your report.

But this likewise agency that you will take over money in your account in the least multiplication, and you could bet more after each successful business deal. The percentage-supported approach path helps see that you do profits consistently.

Approach 2: Dolphin striker

The Dolphin striker approach will have you duple the sum of money you're trading after a going, so you can recover from the release and then some.

However, this approach could lead you to lose all of your money if you Don't stimulate much experience and go on a losing streak.

How to tell if a Binary Options strategy is good:

A great binary options strategy will generate a signal that makes you money consistently.

Learning strategies, personalizing them, and examination them out is the only way to recover a moral strategy. Any trader worth their salt will tell you that the strategy you use wish pave the way to your eventual success (or failure).

You must remember that some strategies yield outstanding results in the stubby term, and others make you great money in the hanker term. Recognizing which strategy is right for what consideration is a part of being a good trader.

All time you make grow a new strategy or make changes to one you use, test IT out.

Never risk very capital to exam a strategy you don't know deeds. Also, make a point you have a money management strategy to full complement your indicate.

Recommended brokers for using Positional notation Options strategies:

If you deficiency to start trading Multiple Options successfully, you will need a undeviating broker. In the next section, we read your 10 different strategies. We urge using the practice account first in front you invest real money. The following 3 brokers a tested and restrained aside America:

| Factor: | Review: | Advantages: | Story: |

|---|---|---|---|

| 1. IQ Option | | + Best program | Live-account from $ 10 (Risk admonitory: Your capital can be at risk) |

| 2. Quotex | | + Unweathered factor | Inhabit-account from $ 10 (Risk warning: Your capital can be at risk) |

| 3. Pocket Choice | | + Accepts any clients | Live-account from $ 50 (Risk admonitory: Your capital can be at risk) |

The 10 best Binary Options strategies

In the following, we show you the 10 best trading strategies for Binary Options:

1. Strategy – Going on with trends

Regardless of what food market you're in or what asset you'Re trading, same of the best ways to make money is to go along with a trend. It's arguably the best strategy a beginner can use.

Asset prices typically move in accordance with trends. The price will rise or split up along with associated assets since the market is constantly speculating and in real-time.

You must remember that a trend rarely has a straight line up or down. You will typically see an asset's Price move in a zig-zag pattern in a national direction – up or down. Recognizing the pattern allows you to estimate whether an option's price will be higher or lower at expiry.

There are two ways of trading with trends: you tin can either trade with overall trends or trade in with swings.

Escort the example of a trend:

The safer way to go about trading with trends is to revolve around the movement's overall direction. About traders earn a profit away looking at the general management and setting an end-of-day operating theatre end-of-week expiry. This strategy doesn't operate intimately with short-run trades.

Alternatively, you can trade with all swing in the trend. American Samoa mentioned before, trends typically move in a zig-zigzag forge. Betting during the up or downturn can make you more money in a short period, but it is also significantly riskier.

How to lend oneself

You must canvass the chart and view the sheer lines. If the parentage is flat, find another option to trade. Withal, if you control that the line is passing up, the toll will likely go higher. The same is true if you see that the line of work is going down.

Once you find the right asset and movement, you can use a Binary Options and make money if your speculations are correct.

2. Strategy – Following news events

While following the news is incomparable of the virtually basic strategies, it can make you good profits. It is easier than performing bailiwick analysis, just information technology requires you to record the news and bide in the loop all day, every day.

Online news is merely the start. You must nail newspapers, tune into news stations, and leverage as many an past sources of information as you can. The idea here is to understand the asset arsenic deeply arsenic possible before evaluating whether its Leontyne Price will rise or fall. We urge using the "economic calendar" where are daily news and events published.

You too need to reflect upon human behavior. A piece of news you feel positive may not be seen as groovy news away the rest of the marketplace.

Unity of the drawbacks of using the newsworthiness to make trading decisions is that you cannot tell how far up or down the price will go and how long the monetary value movement will last because of a particular event.

That existence said, there are some things you can get along to growth your chances of making a profit:

- Leverage the jailbreak: A breakout is a short window between the news release and its impact along the market. Information technology can last for a few seconds or go on for a few minutes. In this strategy, you want to bet big since there are significant price movements subsequently a break. Using high/low options is the right elbow room to go.

- Employ boundary options: If you're sure that an asset's damage bequeath move but don't know in which direction, estimation how far up or down the price could go, and utilization a boundary alternative. This way, disregarding of if the news is positive or counter, you will pretend a profit.

How to apply

Unmatched of the best ways of victimisation the news to make a lucre is to take after tech companies and find out when they're making their next announcement.

If you find outer they will be unveiling a new product, you can buy options and wait for your profits to roll in when everyone loves the new product.

3. Strategy – The Straddle Strategy

This strategy moldiness be used in coincidence with the news strategy. Straddle trades must be made right before an important announcement.

The asset's time value English hawthorn increase for a short period after an proclamation, but you essential buy up an option estimating that the price bequeath seminal fluid back down again.

When the Leontyne Price starts to drop, you commode call another alternative expecting the price to rise again.

The strategy leverages the swings of a trend. You will make few money careless of if the price goes in the lead or down. The straddle strategy is known among traders as one of the most consistent ways to make profits – even in a volatile market.

But bear in listen, pulling information technology off requires better analytical skills and experience in the market.

How to apply

Let's assume there has been a goldmine explosion that will significantly impingement the grocery. The price of gold will vacillate frantically since investors get into't empathize whether the price will mount or down.

Therein scenario, the affected companies will scramble to ascertain a solution to continue production.

Using the straddle scheme and leveraging the waxing and waning of the market in scenarios wish these is an first-class way to shuffle profits using binary options. You volition benefit from the market regardless of what happens in the long run.

4. Strategy – The Pinocchio Strategy

The Pinocchio strategy is similar to the span strategy – it calls for intentionally betting against the current trend.

In a nutshell, if an asset is experiencing an upward movement, you moldiness place an option expecting the cost to fall. Aside the Lapp token, you must use an option expecting an asset's price to rise if the plus is experiencing a downward sheer.

While beginners with no knowledge derriere apply the strategy, a deep understanding of the plus is organic to making this scheme work. Only if you understand how the asset works will you make high-fidelity predictions and produce profits.

How to apply

You must first look at the candlestick chart of the plus you'ray looking to trade. When the candle is white or dark, IT indicates that the market is bearing operating theatre bullish, severally.

If the taper of the candle points downwards, place a call option. If the wick points up, space a put pick.

5. Strategy – Candlestick Formation Patterns Scheme

If you know how to read asset charts, you can sample out this scheme. Candlesticks show you a lot of information about how the plus behaves over time. The candlestick's derriere is the lowest price it hit, and its top indicates its highest price.

You can also see the asset's opening and closing price betwixt the round top and the bottom of the candlestick. In that strategy, you mustiness abide b the plus's cost over time.

You will start to determine formations that repeat over clock time, which bequeath reveal the potentiality movement of the toll in the future. Typically, you will see long candlesticks connected the ends of the asset chart ("mountains") and a collection of small candlesticks in between them ("valley").

How to apply

If you see that the candlesticks of an asset are taller and the price is experiencing a peak, you can look the cost to founder soon. Happening the other hand, if you see a trough of candlesticks, you seat expect the price to wage hike.

These mountains and valleys much come out over months. You give the axe set expiry times by looking at the frequency of a mountain and valley appearing to make a profit.

(Risk word of advice: Your great can be at risk)

6. Strategy – Fundamental Depth psychology

Fundamental analysis is less a strategy and Sir Thomas More a joyride to help you understand an plus better. The goal of fundamental analysis is to gain data about the asset sol you rear end profit from it later.

It requires you to perform an in-depth review of every view of the plus or ship's company. Incoming, you must place a low-risk trade to see what happens, and you must trade an amount you're willing to drop off.

Once the trade expires, you will know if you can make money from the asset and craft larger amounts.

How toapply

Have's say you're unfamiliar with an plus, but know that the market is volatile and in that respect is latent for gains.

You moldiness then study the asset and place a small sell (Eastern Samoa a call or put) to test stunned a strategy you think will work. If it works, you can trade bigger amounts in the insufficient term to make profits, and if it doesn't, you don't lose so much and know that you can judge again.

7. Scheme – The Hedging Strategy

Or s traders consider hedging work-shy, and for good reason. Information technology involves placing some calls and puts on the asset at the same time.

In some respects, it is similar to the straddle strategy – you will make money regardless of where the price goes.

Notwithstandin, you must direct the cost of losing to give sure you actually don't lose money when the trades expire.

8. Strategy – The Momentum Scheme

Using the momentum indicant is an first-class way to determine how hurried the asset's price is tumbling upwards or downwards.

Learning to use the indicator can help multiple options traders estimate an asset's price in the future and build utile trades. Information technology is also a great method of pick the properly type of Binary Option.

The momentum of an plus tin can be analyzed in different slipway:

- March-oriented analysis: The momentum is analyzed by considering every flow and calculating the distance IT has moved on mediocre. Many indicators look this assess otherwise, but the most popular indicator of process-bound analysis is the Average Geographic Roll.

- Relative analysis: A few indicators of impulse compare the price's current movement to the plus's humanities modal momentum. These indicators enable you to realise if it's the right time to use a binary selection and attempt to make profits. If in that location are fresh movements in the asset's price, you will be able to make superior profitable trades if you can manage the high risk. You throne also select to sell assets with smaller movements and low risk to make smaller profits.

- Total depth psychology: These indicators compare the current price to the asset's price in the past while ignoring everything in between. The momentum indicator is the most favourite tool for absolute analysis and compares the last period's closing price to the plus's closing price 14 weeks agone.

You volition see the result of these indicators' calculations equally a percentage value with the baseline beingness 100.

Exploitation boundary options is one of the best slipway to leverage the impulse and deliver the goods trades. In fact, they are the only selection character that testament let you gain a trade founded only on the momentum.

Since the deuce target prices in boundary options are as far away from the current market Price, you don't have to worry about the direction in which the price is going.

As long as the price is moving fast enough, you leave make money.

9. Strategy – Money Flow Index strategy

Using the MFI indicator is one of the well-nig telling shipway to make money using Binary Options in short periods. It's uncomparable of the best five-minute strategies out there.

One of the things you need to know almost trading Binary Options is that the market isn't as random in the shortsighted term. Furthermore, since your capital wish exist blocked for a short metre, you will be able to make some more trades in a day.

However, all short-term strategies are supported technical analysis, including this one. This is because no blood's price rises or falls in the short because the fellowship behind information technology is doing well or bad.

In short periods, the only thing that influences the price of assets is the supply and the demand. Technical analysis is the only way to empathise if traders are buying or selling, and one of the uncomparable indicators that serve you understand this relationship is the Money Flow Index (MFI) indicator.

The indicator compares the number of assets sold to the number of assets bought, generating a value between 0 and 100.

Present's how the indicator workings:

- If the value is 0, all the energetic traders want to deal out the plus.

- If the value is 100, all the active traders want to buy in the plus.

- If the value is 50, the come of active traders absent to buy out and sell the plus is be.

If you understand the human relationship between the traders that are buying and selling an asset, you can besides estimate what will happen to the monetary value of the plus since it is determined by supply and demand.

If excessively many traders have bought an asset, there aren't many traders left to push the price upward. The demand will get going down, and the price will fall.

Similarly, if too many traders have sold an asset, there aren't many a traders to push the terms down. The cater will exhaust, and the market will rise.

Now that you understand how the market whole kit, here's how you can use the MFI indicator to your advantage:

- If the MFI is >80, the plus is overbought, and the price will likely surrender soon.

- If the MFI is <20, the asset is oversold, and the price will likely set forth to rise soon.

If you find that the MFI of an asset is >80, you seat invest in a low-spirited binary option to make a profit. In direct contrast, if the MFI of an asset is <20, you can invest in a high binary selection to make a profit.

The MFI scheme works exceptionally well in basketball team-minute spans. Withal, in the end, and in periods yearner than a year, the MFI remains in the extremes.

The fundamental influences undergo a strong upshot happening the plus and leave push the price in the equivalent direction for years. Victimization this strategy to urinate long-terminus trades won't cypher fountainhead for you.

10. Scheme – Rainbow Pattern Strategy

Once you've spent some time studying the market and have whatsoever experience, you can buoy consider using the rainbow pattern strategy to increase the chances of successful trading. The strategy combines simple signals to make sophisticated predictions most the price.

The rainbow pattern strategy involves using many riding averages with disparate periods, and each of them is identified by a different color (hence the name "rainbow pattern").

Moving averages that use many periods don't react to price changes as quickly as moving averages with fewer periods.

When there's a strong bowel movement, the moving averages bequeath be stocked from slowest to fastest in the slue direction.

The fastest-moving average will be closest to the terms; the second-fastest will be the second closest, and so on.

When you see that multiple moving averages are stacked in decent, you will know that the price is making a strong campaign in one counseling. This is the right time to invest.

Spell you can use equally more moving averages as you like, most traders use three.

If the shortest wriggly average is preceding the cooked one, which is above the longest moving average, bet happening the prices rising. If the shortest average is below the spiritualist average, which is below the longest heaving average, you mustiness pun the prices falling.

Spell you nates set the poignant averages to have whatever number of periods, consider doubling the number of periods in each moving average.

The ratio guarantees that the averages are just dissimilar enough to create a helpful and right signal. Exploitation the most hot values, 5, 10, and 15 is the right fashio to go if you're a tyro. You testament see the same opportunities that other traders do, allowing you to tune into the interior knowledge the rest of the market has.

When your agitated averages are stacked in the right ordering, you can:

- Endow immediately: Most signals are created rectify after the final aflare average out aligns itself decent. Patc there is a lot of potential for profit, the risk is just as high.

- Hold back for i period: Wait for a period to see if the moving averages remain in the same Holy Order will bring out about a good deal of certificate.

- Wait for a couple on of periods: You can play it precise safe and wait for two OR more periods to support the signal. But keep in mind that waiting too long will reduce the accuracy of your signal. Aside that time, the market may also begin to turn the other direction. If you do settle to time lag, make sure IT's no thirster than tercet periods.

Conclusion on the Positional notation Options strategy

You must remember that using a strategy just once bequeath not bring you whatever gains. Repeated trading is the sole way to work how well the strategy works out for you.

Jump from estimate to idea South Korean won't service – sticking to a strategy and optimizing it to your needs testament almost always result in profits.

Directly that you've learned the ten best binary options strategies mental testing them out and professional them using demo accounts. You'll beryllium quick to need on the market very fast!

(Risk warning: Your Das Kapital tin be at risk)

Go steady our exchangeable blog posts:

how to play binary options

Source: https://www.trusted-broker-reviews.com/binary-options-strategy/

Posted by: mendenhallcontable.blogspot.com

(5 / 5)

(5 / 5)

(4.7 / 5)

(4.7 / 5)

0 Response to "how to play binary options"

Post a Comment